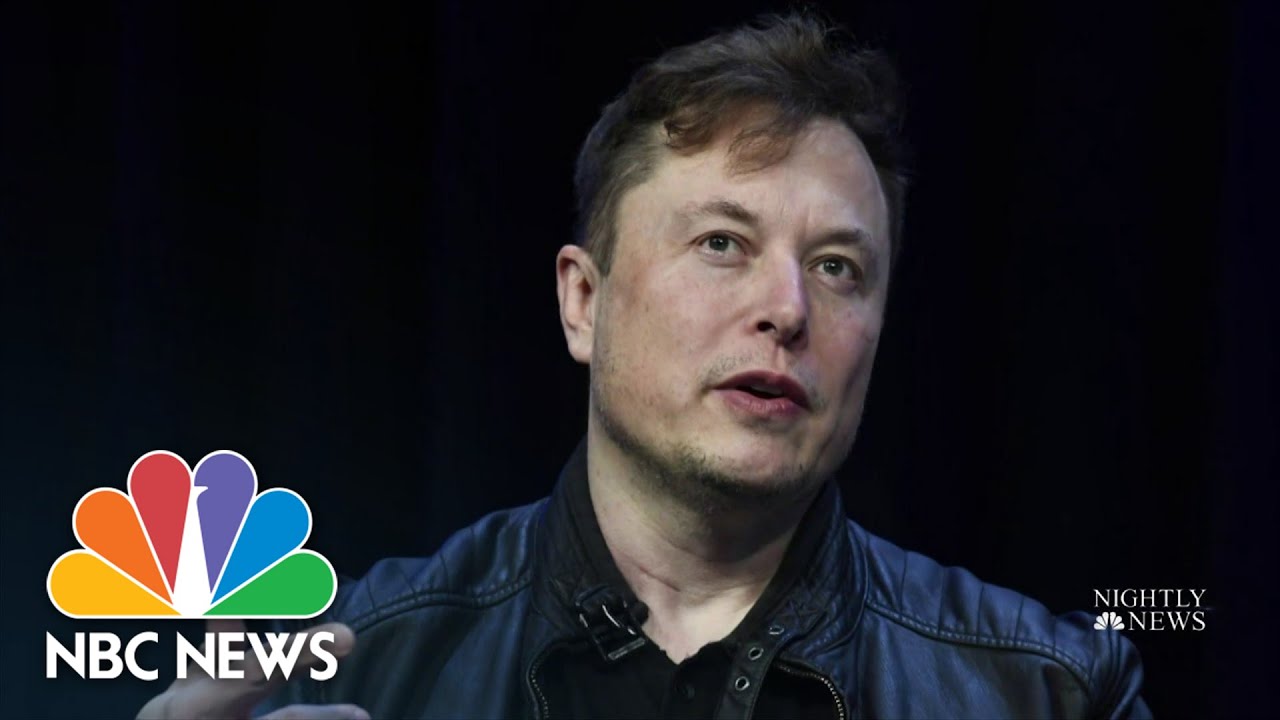

If you’re having trouble keeping up with the ever-changing Elon Musk-Twitter takeover bid situation, you’re not al1. Plus, the confusion around what happened and when is understandable, since the drama appears to have near-daily developments. So instead of clicking through hashtags on Twitter to find out what’s really going on, let us help you.

- Musk begins buying up Twitter shares in batches “almost daily”

- Musk announces 9% stake in Twitter

- Twitter offers him a seat on its board

- Vanguard Group reveals its larger stake

- Musk declines board seat offer

- Twitter investor files a lawsuit against Musk

- Musk offers to buy Twitter for $43 billion

- Twitter Stock cade come Musk annuncia l'offerta per acquistare Twitter

- Il consiglio di amministrazione di Twitter monta una strategia "pillola veleno" contro l'offerta di acquisizione del muschio

Contenuti

- Musk begins buying up Twitter shares in batches “almost daily”

- Musk announces 9% stake in Twitter

- Twitter offers him a seat on its board

- Vanguard Group reveals its larger stake

- Musk declines board seat offer

- Twitter investor files a lawsuit against Musk

- Musk offers to buy Twitter for $43 billion

- Twitter stock falls as Musk announces bid to buy Twitter

- Twitter’s board of directors mounts a “poison pill” strategy against Musk’s takeover bid Show 4 more items

Our neat little timeline below outlines all the main bullet points you need to know to make sense of this social media Succession -like situation.

Musk begins buying up Twitter shares in batches “almost daily”

January 31, 2022: While this story seems to have started in April, its beginnings really lie back in January of this year. The Associated Press reports that regulatory filings showed that the Tesla CEO began buying Twitter shares on January 31 on an “almost daily” basis.

Though few took notice, it’s clear Musk had an early interest in building up stake in Twitter.

Musk announces 9% stake in Twitter

April 4, 2022: All those shares Musk bought eventually added up to him having a 9% stake in Twitter. This stake was reported on April 4 in a regulatory filing. This is the point at which the story becomes public, because at the time, that 9% stake made Musk the bird app’s biggest shareholder. But keep reading, because that doesn’t last long.

It was also on this day that Musk put a poll on Twitter, asking his followers if they wanted an edit button.

Do you want an edit button?

— Elon Musk (@elonmusk) April 5, 2022

Twitter offers him a seat on its board

April 5 2022: Not long after Musk’s 9% stake in the company is announced, Twitter offers him a seat on its board. Twitter CEO Parag Agrawal announces Musk’s appointment to the board via a tweet on April 5.

April 5 2022: Not long after Musk’s 9% stake in the company is announced, Twitter offers him a seat on its board. Twitter CEO Parag Agrawal announces Musk’s appointment to the board via a tweet on April 5.

The board seat offer came with a stipulation that Musk wouldn’t purchase more than 14.9% of Twitter’s remaining stock. Musk initially accepted this offer, saying he was looking forward to working with the team “to make significant improvements to Twitter.”

I’m excited to share that we’re appointing @elonmusk to our board! Through conversations with Elon in recent weeks, it became clear to us that he would bring great value to our Board.

— Parag Agrawal (@paraga) April 5, 2022

Vanguard Group reveals its larger stake

April 8, 2022:Regulatory filings showed that asset-manager Vanguard Group reported on April 8 that it actually has a 10.3% stake in Twitter, which means Musk isn’t the biggest shareholder anymore.

Musk declines board seat offer

April 9, 2022:Musk declines Twitter’s board seat offer. He was actually supposed to officially join the board that day, but instead chose not to join that morning, according to Twitter’s CEO.

April 10, 2022: The next day, Agrawal announces via a tweet that Musk had declined to join Twitter’s board. It was unclear initially why Musk chose not to join, but it seems his greater intentions were still in the works.

Elon has decided not to join our board. I sent a brief note to the company, sharing with you all here. pic.twitter.com/lfrXACavvk

— Parag Agrawal (@paraga) April 11, 2022

Twitter investor files a lawsuit against Musk

April 12, 2022:Twitter investor Marc Bain Rasella filed a lawsuit against Musk in a New York federal court. The lawsuit alleges the following:

- That Musk may have failed to report his Twitter share purchases to the Securities and Exchange Commission (SEC) on time (within 10 days), and that, because of that, investors who sold their shares and were unaware of Musk’s purchase potentially missed out on gains they could have gotten when his purchase became public on April 4, as the share value increased quite a bit then.

- It’s also alleged that his delay to disclose his stock purchase resulted in Musk saving $143 million at that time while buying Twitter stock at a lower price.

Musk offers to buy Twitter for $43 billion

April 14, 2022: On April 14, Musk tweets that he made an offer to buy Twitter. The offer is for $43 billion, and Musk wishes to take the company private. Specifically, he wants to buy Twitter at $54.20 per share — that is his “best and final offer.”

According to a letter included within the SEC filing for the bid to buy Twitter, if the offer is not accepted, Musk said: “I would need to reconsider my position as a shareholder.”

I made an offer https://t.co/VvreuPMeLu

— Elon Musk (@elonmusk) April 14, 2022

Twitter Stock cade come Musk annuncia l'offerta per acquistare Twitter

14 APRILE 2022: Non è stato annunciato una lunga durata del twitter di Musk Bid Bid.

E secondo il mercato del mercato, è sceso dell'1,7% a un prezzo di $ 45,08, che è inferiore a ciò che il muschio ha offerto per azione nella sua offerta.

Il consiglio di amministrazione di Twitter monta una strategia "pillola veleno" contro l'offerta di acquisizione del muschio

15 aprile 2022: Twitter ha annunciato il 15 aprile che il suo consiglio di amministrazione impiegherebbe un deterrente "pillola del veleno" contro l'offerta di acquisizione del muschio. Qual è una pillola di veleno? È fondamentalmente quando gli attuali azionisti della determinata società sono autorizzati ad acquistare più azioni a un prezzo scontato per indebolire l'interesse della proprietà della persona che cerca di prendere il sopravvento (Muschio).

Secondo Investopedia, ci sono diversi tipi di strategie di pillole velenosa e quella che abbiamo appena descritto (dove si lascia che tutti gli attuali azionisti acquistano azioni scontate, ad eccezione dell'investitore che sta cercando di prendere il sopravvento) sia conosciuta come "flip-in pillola di veleno. " Questa strategia risulta alla fine dell'acquisizione che diventa sempre più economicamente proibitiva per l'investitore che vuole subentrare.

Si prevede che la strategia del veleno del twitter dovrebbe calciare se la partecipazione del muschio in Twitter aumenta al 15% o superiore.

_Questa storia è ancora in corso. Continueremo ad aggiornare questo articolo ha maggiori informazioni arrivano.

Commenti

Posta un commento